Micro-sercive migration

We like your product and have no major issues with it, but your Invoicing is shit. – Churned Major Enterprise Client

Client

Temper

Industry

Online platfrom

Service

Design management

UX Engineering

Product Design

User Research

1/5 Discovery

Temper’s invoicing system is an outdated monolith. It’s messy, not compliant, and can’t handle upgrades. Enterprise clients are complaining and many have churned. Invoicing was a system that everyone understood, and used differently.

Challenges:

Millions in ARR decrease 2% Y+1 reinforced decrease

71% error rate 90% for Enterprise

Increased Enterprise Churn, many only for Invoicing

Limited access to Business verticals for Invoicing

Outcome:

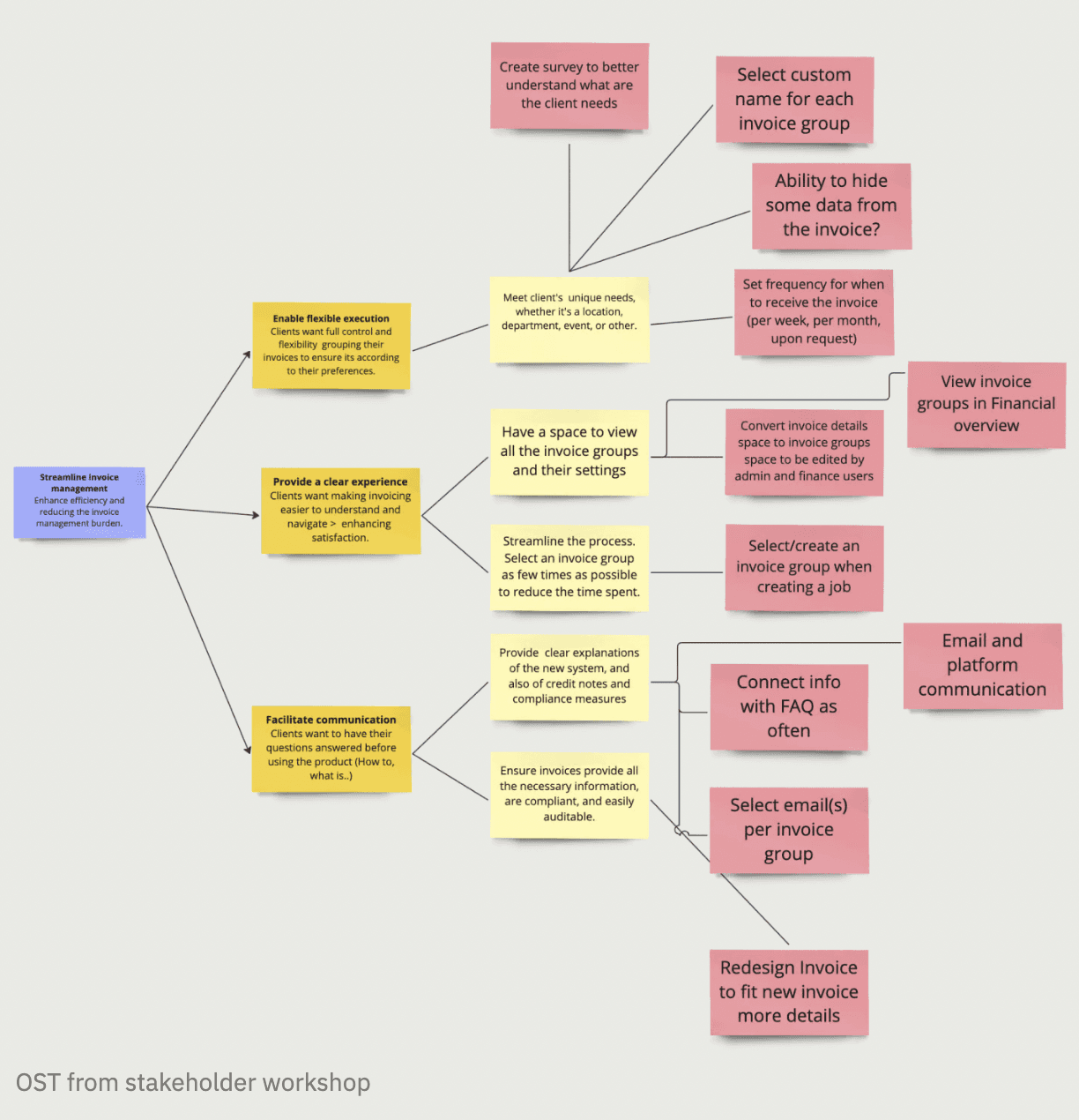

Rebuild the invoicing system through small, lean releases to create a customisable payment experience that boosts retention and supports growth, at 0 friction.

2/5 Foundations

We planned a migration strategy to move clients at minimal friction, while experimenting solutions and minimising risk. Everyone had to know what is happening. We trained the teams, iterated frequently, and migrated gradually.

Invoicing should no longer be a challenge for growth: Frontline work clients come from various verticals, each with a unique invoice profile. Flexibility is the only way.

Everyone can understand Invoices differently, but everyone should use it the same: Bringing all stakeholders into a unified vision was hard and critical. There’s work for everyone.

3/5 Design delivery

The Financial overview section was redesigned with efficiency, flexibility and education in mind. The revamp included access to more data, clearer overview of finance on Temper, as well as flexible use of Invoicing.

Billing Profiles: Billing Profiles is an opt-in feature to automate when an invoice generated, who receives it, and what’s on it?

Some insights we got:

40% did not feel safe only seeing the Company name when creating a profile. So we added the existing company in the create Billing profile workMost clients set email recipients on a general company level. So we moved Email recipients to Companies & branches instead of customising it as well.

Financial Overview: Data overview to share insights on spendings, breakdown, and financial behavior on Temper.

More insights: 70% of the clients asked for more granular insights. So we are planning followup sessions with clients and AMs to increasnig value of Financial Overview.Cost breakdown was useless for many, and a winner for some So we kept it 🤷♂️

Invoice Management: Extra tools for Finance users to manage their references, adding custom notes and references.

4/5 Impact

+€12,1M MRR This projection is driven by our ability to attract and retain clients events, and construction sector.

27% conversionFor Finance users due to added insights and information on spending behavior.

100% complianceWe achieved a remarkable improvement in the reliability of our invoicing system, increasing the success rate from 71% to 99.90%.

5/5 Next steps

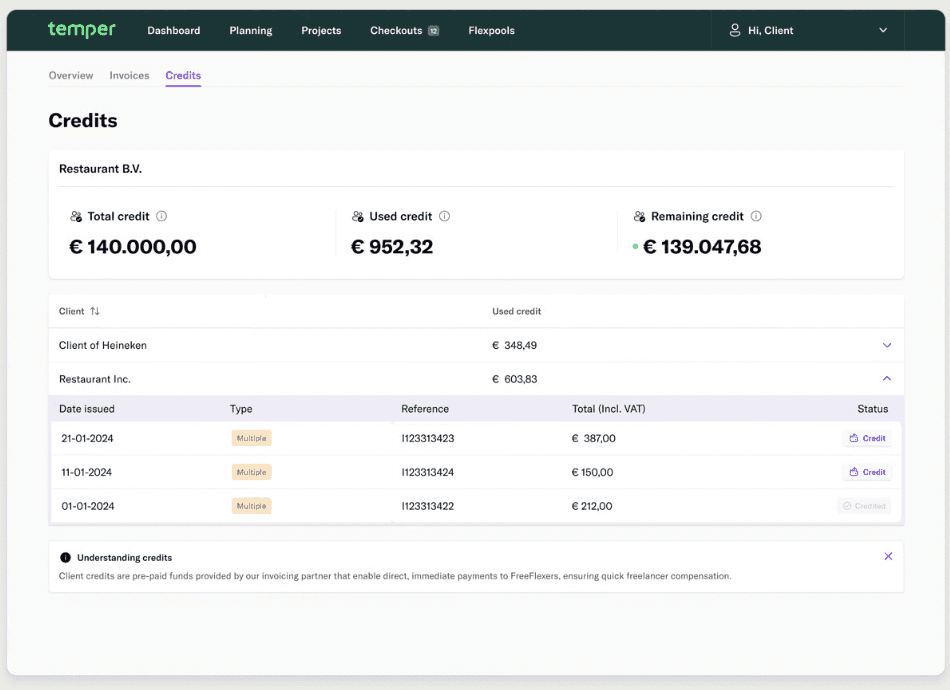

Credit Management: New section to manage credits across Enterprise branches and companies.

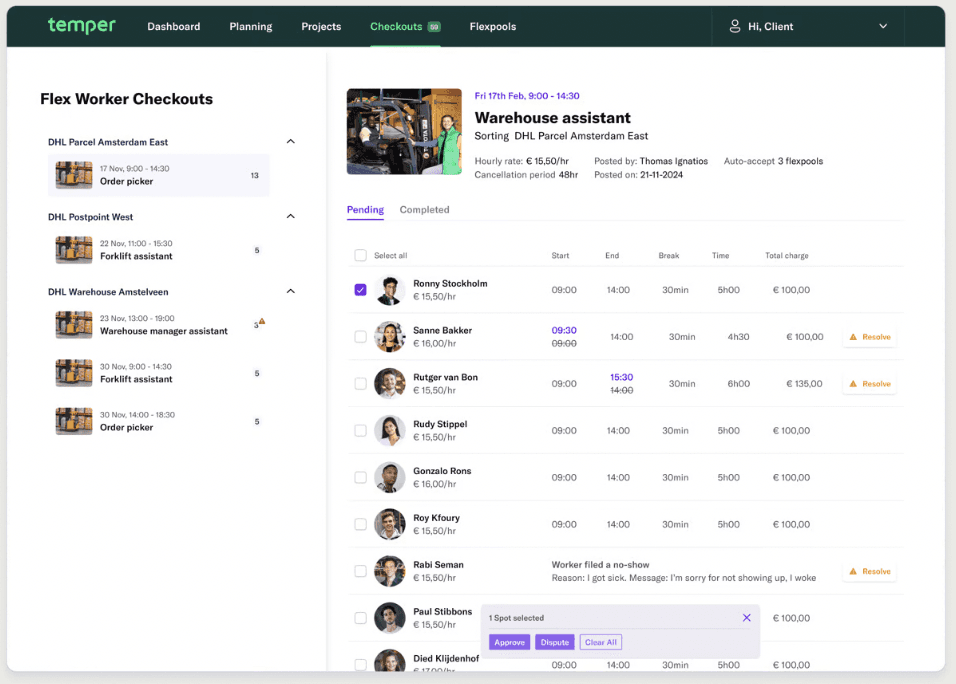

Streamline Checkout: New section to manage credits across Enterprise branches and companies.

Next Projects

View our other projects works that highlight our range of skills and innovative design solutions