Turning payments into a scalable growth engine

Role

Design Lead @ Temper EU

Industry

Human Resources

Duration

9 months

Responsibility

Research & Discovery

Design Management

Data Analysis

UX Engineering

Workshop Facilitation

Team

Senior PM

EM

2x Front-End Engineers

3x Back-End Engineers

Visual Designer

Stakeholders

CEO

Account Management

Finance & Legal

Compliance

Tax Auditors

TL;DR

Temper's invoicing monolith was driving enterprise churn. 53% error rate, non-compliant, blocking new verticals. I led the design of a migration that rebuilt invoicing as a modular micro-service, prioritizing billing logic over UI improvements.

99.99%

Invoice success rate improved from 71%

90%

compliance across invoicing flows

+27%

conversion among finance users

+€12,1m

projected ARR from new businesses unlocked

Disclaimer: Confidential information has been omitted or obfuscated. This case reflects my own perspective and does not necessarily represent the views of Temper.

Context

We like your product and have no major issues with it, but your Invoicing is shit. – Churned Major Enterprise Client

Temper's invoicing monolith was bleeding enterprise revenue.

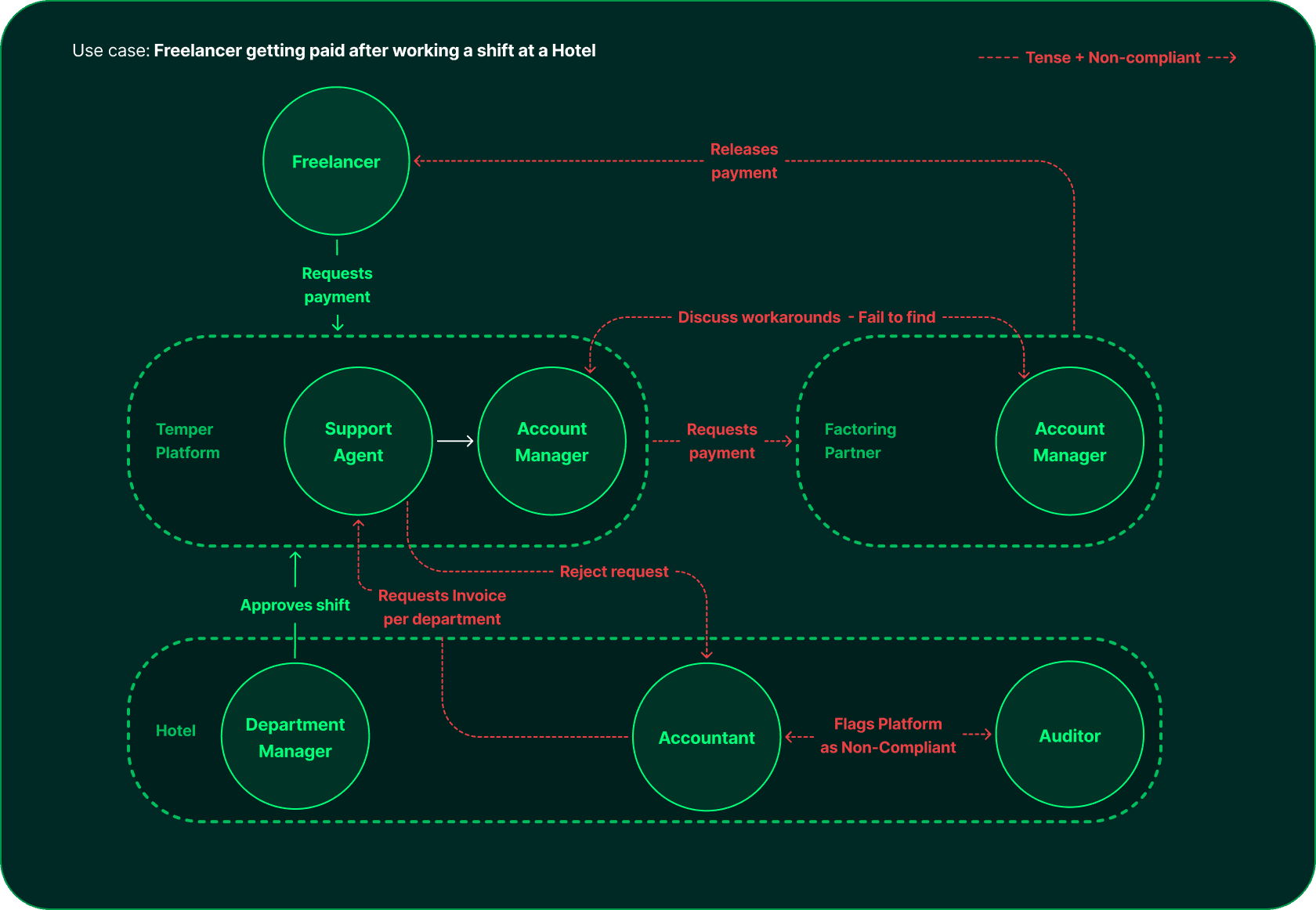

Enterprise clients were churning specifically because of invoicing. The system was a monolith; Every client, vertical, and billing entity shared the same rigid logic, which meant every new requirement introduced edge cases, workarounds, and compliance risk.

We agreed to rebuild invoicing as a modular system through incremental migration, not a big-bang rewrite, so clients could be moved gradually while we validated each layer.

Challenges:

Millions in ARR decrease

2% Y+1 reinforced decrease

71% error rate for Enterprise

Enterprise Churn, many only for Invoicing

Limited access to Business verticals

YoY worked hours analysis

Snippets from the strategy deck

Foundation

Migration-first: stabilize billing logic before touching surfaces

Everyone used invoices differently, so I started by mapping and diagnosing the technical logic. Frontline work clients come from various verticals, each with a unique invoicing and payment preferences. For Temper to grow, we had to adapt.

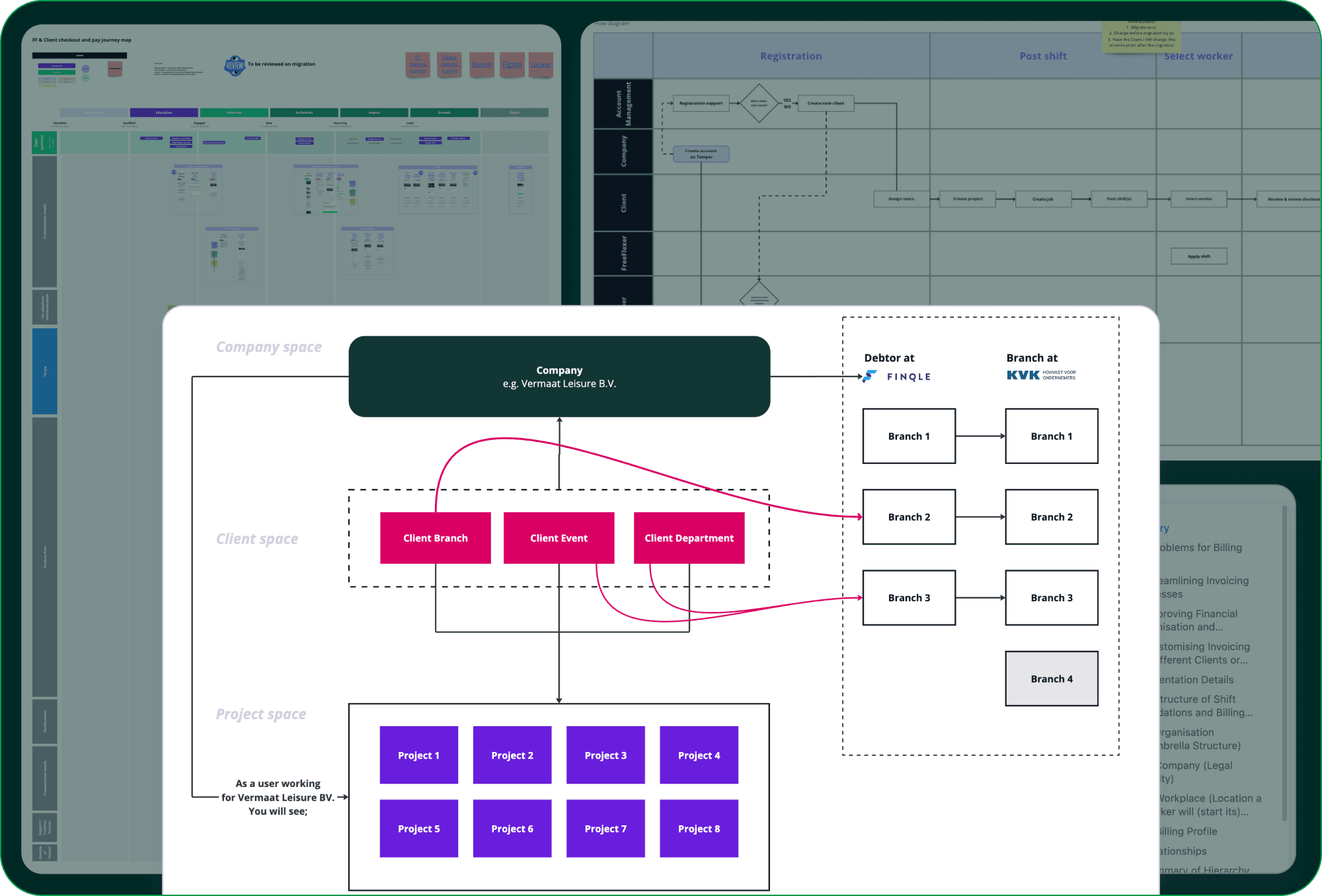

Mapping of VAT IDs across 3 spaces: Temper, Factoring partner, Chamber of Commerce

First UI iterations

Delivery

We rebuilt invoicing to support multiple business models without per-client custom logic

Fixing billing logic first meant every surface built on top would inherit compliance and correctness by default. And also unlocked access to new verticals such as Events, and Construction.

I made the call to start with billing logic, not surfaces. Fixing how invoices were generated, attributed, and validated first meant every subsequent feature (financial overview, invoice management, credits) scaled without edge-case rework.

Billing Profiles

Billing Profiles is an opt-in model defining when invoices are generated, who receives them, and what they contain. It introduced an explicit layer where each invoicing context could be tied to a single, correct VAT ID.

Enterprise Auditors: Create multiple billing profiles under one account, each mapped to a unique VAT ID,

Temper: Ensure every invoice was legally compliant without duplicating customers or introducing custom logic.

The legal discrepancy was rooted in the API itself

Large enterprise clients operate multiple legal entities, each with its own VAT ID registered in the KVK. Temper historically supported a single VAT ID per enterprise, our factoring provider's API had a VAT ID per entity that is from other subsidiaries. We couldn’t change how VAT data was structured at Finqle, but we could control how VAT IDs were surfaced on our platform.

Most clients set email recipients on a general company level.

So we moved Email recipients to Companies & branches instead of customising it as well.

Financial Overview

Invoice Management

Impact

+€12,1m projected ARR

This projection is driven by our ability to attract and retain clients in events, and construction sectors.

27% conversion

For Finance users due to added insights and information on spending behavior.

90% compliance

Invoice success rate went from 71% to 99.99%. The system that was driving enterprise churn became the foundation for new vertical expansion.

Beyond the metrics, Account managers went from firefighting invoice errors to onboarding new verticals. The system stopped being a liability and became a growth lever